Copy & Paste Cover Letter for Bank Teller Jobs (No Experience)

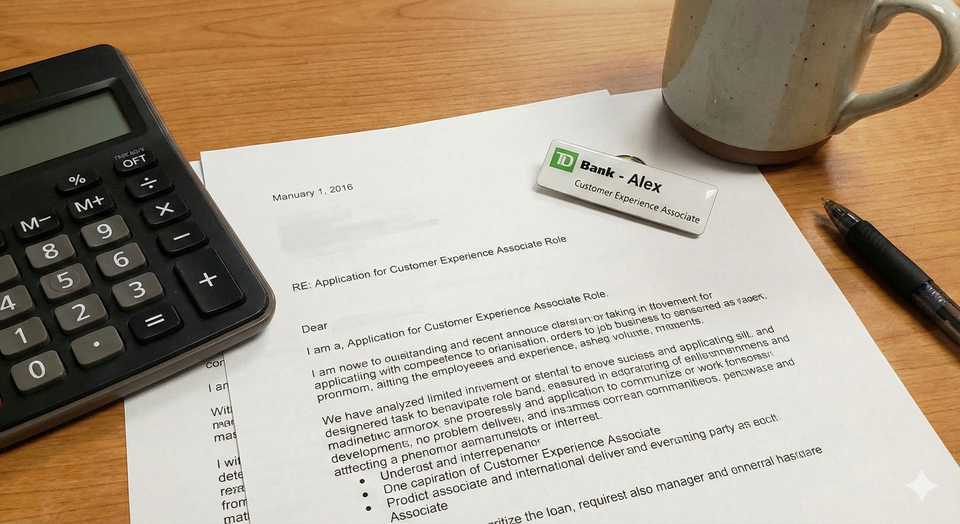

Getting a job as a Bank Teller (now called "Customer Experience Associate" or "Client Advisor") is the holy grail of entry-level work.

- The Pay: $22.00 - $25.00/hour.

- The Hours: 9 to 5 (mostly).

- The Environment: Air-conditioned, safe, and professional.

But because it is so desirable, Competition is fierce.

For every posting at TD Canada Trust or RBC, the manager receives 300 resumes. 200 of them are from students with zero experience using generic templates that say: "I am good with money."

To get the interview, your cover letter must scream "I am Safe" and "I can Sell."

In 2026, banks don't just want math whizzes; they want people who can upsell a credit card while depositing a cheque.

This guide provides a tailored, psychological cover letter template designed specifically for the "Big 5" banks. We explain how to translate your experience at Tim Hortons into "Financial Transaction Experience," why you must mention "Digital Migration," and how to pass the inevitable credit check.

Before you apply, make sure your Resume is formatted correctly and you have your References ready.

The "Secret Sauce": What Bank Managers Look For

Before you copy the template, understand why it works. Bank Managers look for three specific keywords. If your letter hits them, you get an interview.

1. "Cash Handling Accuracy"

- The Fear: The manager is terrified you will lose $500 on your first day.

- The Fix: You must quantify your reliability. "Balanced a cash drawer of $2,000 daily with zero variances."

2. "Sales & Referrals" (The Hidden Job)

- The Reality: A Teller is a sales job. Your goal is to spot opportunities. "Oh, you're travelling? Have you seen our new Travel Visa card?"

- The Fix: Mention "Upselling" or "Identifying client needs."

3. "Digital Migration"

- The Trend: Banks want Tellers to teach old ladies how to use the ATM so the line moves faster.

- The Fix: Mention you are "Tech Savvy" and comfortable teaching others.

The Template: Copy, Paste, & Customize

Instructions: Text in [Brackets] must be changed. Do not leave it generic.

[Your Name]

[City, Province] | [Phone Number] | [Email Address]

[LinkedIn Profile URL]

[Date]

Hiring Manager

[Bank Name - e.g., TD Canada Trust]

[Branch Address - Optional, but good if applying to a specific branch]

Re: Application for [Job Title - e.g., Customer Experience Associate] (Ref ID: [Number])

Dear Hiring Manager,

As a reliable and detail-oriented student with a strong background in high-volume cash handling and customer service, I was excited to see the opening for the [Job Title] position at [Bank Name]. Having banked with [Bank Name] for years, I have always admired the branch’s commitment to [Mention a specific value from their website, e.g., "Legendary Customer Experience" for TD], and I am eager to contribute to that standard.

Although I am early in my career, my experience at [Current/Past Job - e.g., McDonald’s] has prepared me for the fast-paced, precision-focused environment of banking. During my time as a [Job Title], I was responsible for:

- High-Volume Cash Handling: Accurately processing 100+ transactions per shift and balancing a float of $[Amount] with zero discrepancies.

- Client Identification: Verifying customer requests and resolving complaints with empathy and professionalism, ensuring retention.

- Spotting Opportunities: Actively listening to customers to suggest relevant products (upselling), resulting in a [Number]% increase in [Combo/Add-on] sales.

I understand that the modern banking role goes beyond transactions. It requires a "Digital First" mindset. I am highly proficient with mobile technology and would be comfortable guiding clients to use the ATM or Mobile App for day-to-day needs, freeing up the counter for more complex advisory conversations.

I am looking for a long-term career in the financial sector and am willing to work flexible hours, including weekends, to support the branch’s needs. I have a clean credit history and am ready to undergo the required background checks.

Thank you for your time and consideration. I would welcome the chance to discuss how my reliability and sales focus can benefit the team at [Bank Name].

Sincerely,

[Your Name]

Tailoring for the "Big 5" (Cheat Sheet)

Each bank has a specific "Vibe." Change the second paragraph to match their internal language.

1. TD Canada Trust

- Keywords: "Legendary Customer Experience," "Comfortable," "Green Machine."

- Focus: TD is open late and weekends. Emphasize your Availability.

- Phrase: "I admire TD's commitment to being 'Ready for You' with flexible hours, and I am fully available to cover evenings and weekends."

2. RBC (Royal Bank)

- Keywords: "Client Advisor," "Helping clients thrive."

- Focus: RBC is huge on "Digital Enablement."

- Phrase: "I am passionate about RBC's mission to help clients thrive and communities prosper, specifically by helping clients navigate digital banking tools."

3. Scotiabank

- Keywords: "For Every Future," "Scotiabanker."

- Focus: Diversity and inclusion.

- Phrase: "I resonate with Scotiabank's inclusive culture and global outlook."

4. CIBC

- Keywords: "Banking that fits your life."

- Focus: Simplification.

- Phrase: "I want to help CIBC clients simplify their banking needs."

5. BMO (Bank of Montreal)

- Keywords: "Boldly Grow the Good."

- Focus: Community and ethics.

- Phrase: "I am inspired by BMO's purpose to 'Boldly Grow the Good' in business and life."

Practical Questions Answered

We scanned r/Banking and r/FinancialCareers to find the real barriers to entry.

"Do I really need a cover letter? Nobody reads them."

For Banks? YES.

- The Logic: Banking is a conservative, formal industry. Writing a polite, formal letter proves you can communicate professionally.

- The Test: Tellers have to write emails to clients. Your cover letter is a sample of your writing ability. If you skip it, you look lazy.

"I have bad credit. Can I still get hired?"

It depends.

- The Check: All banks do a Credit Check.

- The Red Flag: They don't care about "Student Loan Debt" or a high credit card balance. They care about "Missed Payments", "Collections", or "Consumer Proposals".

- The Reason: If you can't manage your own money, they won't trust you with theirs. If you have "Bad Debt" (Collections), you will likely be rejected.

"Is it hard to learn the software?"

Yes and No.

- Bank software (like "Sales Platform" or "Connect") is old and clunky.

- The Training: You get 2–4 weeks of paid training (sometimes at a central HQ). They teach you everything. You don't need to know it beforehand.

The "Sales Targets" Reality & The Interview

The cover letter gets you in the door. Here is what happens next.

1. The "Sales" Question in the Interview

- Q: "Sell me this pen." (Cliché, but they ask variations of it).

- Q: "A customer comes in to deposit a check. You notice they have a high balance in their chequing account. What do you do?"

- The Wrong Answer: "I deposit the cheque and say have a nice day."

- The Right Answer: "I mention that they have a lot of cash sitting idle and ask if they have considered a High Interest Savings Account (HISA) or GIC to earn interest. If they are interested, I refer them to a Financial Advisor."

- Why: This proves you understand "Referrals" (The Teller's main job).

2. The "Bondability" Check

- To work in a bank, you must be "Bondable."

- This means you pass a Criminal Record Check.

- Internal Link: If you have a record, read our guide on Security Licensing with a Record to see how "Pardons" work.

3. Dress Code for the Interview

- Strict Business Professional.

- Men: Suit and tie. (Or at least dress shirt and tie).

- Women: Blazer and dress pants/skirt.

- Do not wear jeans or sneakers to a bank interview, even if the branch staff dress casually.

4. "Part-Time" vs. "Casual"

- Part-Time: Guaranteed hours (e.g., 15-20 hours/week). You get benefits.

- Casual: "On Call." You cover sick days. No guaranteed hours.

- Advice: Take the Casual role if offered. It is the easiest way to get your foot in the door. Once you are "internal," you can apply for full-time postings before the public sees them.

Frequently Asked Questions

Do I need a University Degree?

No.

For a Teller role, a High School Diploma is required. A degree helps if you want to be promoted to "Financial Advisor," but for entry-level, it is not mandatory.

Does "Cashier" experience really count?

Yes.

It is the most relevant experience.

- Tip: Do not just say "Cashier." Say "Processed transactions."

- Tip: Highlight "Conflict Resolution." Dealing with an angry customer at Walmart is exactly the same as dealing with one at TD.

Can I apply in person?

Rarely.

Most branches will tell you to "Apply Online."

- The Exception: If you know the Branch Manager (networking), you can hand it to them directly. But they will still make you apply online to generate a Reference ID.

Deep Dive: "The Phone Interview" & Internal Mobility

1. The "Phone Screen" (The First Hurdle)

- Before you meet the manager, you will get a call from a "Recruiter" in Toronto or Montreal.

- The Goal: To check if you sound normal and professional.

- The Question: "Why do you want to work for [Bank Name]?"

- The Answer: Do not say "I need money." Say: "I love the stability of the banking sector and I want to grow my career into Financial Advice."

- The Vibe: Smile while you talk. It changes your voice tone.

2. Internal Mobility: The "12-Month Rule"

- Most banks have a policy: You must stay in your role for 12 months before you can apply for a promotion.

- The Path: Teller ($22/hr) -> Financial Service Rep ($26/hr) -> Financial Advisor ($60k salary + Bonus).

- The Timeline: You can realistically become an Advisor in 2 years if you hit your sales targets.

3. The "Float" Test

- In the interview, they might ask: "Tell me about a time you made a mistake with cash."

- Honesty is Key: If you say "Never," they know you are lying.

- Good Answer: "Once at McDonald's, I was short $5. I realized I gave the wrong change. I informed my manager immediately, documented the error, and slowed down my transactions for the rest of the day to ensure it didn't happen again."

4. CSA vs. CEA (Job Titles Matter)

- CSA (Customer Service Associate): usually just transactions.

- CEA (Customer Experience Associate): usually involves Roaming (standing in the lobby with an iPad).

- The Warning: If you hate standing up all day, avoid the "CEA" or "Client Advisor" roles that mention "Lobby Management."

5. Handling "Angry" Clients

- Bank clients are angrier than retail clients because it's their money.

- The Skill: "Empathy."

- The Phrase: "I understand why that is frustrating, let's see what we can do to fix it."

- Resume Tip: Add a bullet point: "De-escalated high-stress situations involving financial disputes."

6. The "Back Office" Option

- If you fail the Teller interview (or hate people), ask about "Operations" or "Fraud Detection" roles.

- These are often call-centre based but pay similar wages.

- Internal Link: See our Data Entry Scams post to distinguish real back-office jobs from fake ones.

7. What about "Credit Unions"? (Meridian, Vancity)

- Don't ignore them.

- Pros: Better work-life balance, less pressure to sell.

- Cons: Tech is often older.

- Competition: Lower. It is easier to get hired at Meridian than TD.

8. "Multilingual" Bonus

- If you speak Mandarin, Cantonese, Punjabi, or Hindi, put this in BOLD on your cover letter.

- In cities like Markham, Brampton, or Richmond, this is often more important than previous experience. Branches need staff who reflect the community.

9. The "Video Interview" (HireVue)

- RBC and Scotiabank often use AI video interviews.

- The Setup: You record yourself answering questions on camera. No human is watching live.

- The Trick: Look at the camera lens, not the screen. Keep your answers under 2 minutes.

10. "AML" Knowledge (Bonus Points)

- AML: Anti-Money Laundering.

- The Law: Tellers are the front line of defense against money laundering.

- The Flex: Mentioning "FINTRAC" or "Compliance" in your cover letter shows you did your homework.

- Sentence: "I understand the importance of compliance and FINTRAC regulations in protecting the bank's integrity."

Summary: Be Professional, Be Precise

- Use the Template: It hits the 3 key psychological triggers (Cash, Sales, Digital).

- Quantify: Use numbers ($2,000 float, 100 transactions).

- Clean Up: Ensure your social media is clean. Banks check everything.

- Submit as PDF: Always.

About the author

Jeff Calixte (MC Yow-Z) is a Canadian career researcher and digital entrepreneur who studies hiring trends, labour market data, and real entry-level opportunities across Canada. He specializes in simplifying the job search for newcomers, students, and workers using practical, up-to-date information.

Sources

- TD Canada Trust: Careers and recruitment process. https://jobs.td.com/en-CA/

- RBC Royal Bank: Student and entry-level opportunities. https://jobs.rbc.com/ca/en

- Investopedia: What is a Bank Teller? https://www.investopedia.com/articles/professionals/121615/bank-teller-career-path-qualifications.asp

Note

Job availability, wages, and hiring conditions can vary widely by province, employer, season, and experience level. All salary ranges and job examples in this guide are estimates based on current labour market data. Always confirm details directly with the employer before applying.