Ontario Vacation Pay Calculator: 4% vs. 6% Rules (2026 Guide)

In Ontario, Vacation Pay is the most stolen form of wages.

Why? Because the math is confusing, and most employees assume their boss is calculating it correctly.

Here is the reality:

- If you have worked for the same employer for 5 years or more, you are legally entitled to 6% vacation pay (3 weeks).

- If you are a Part-Time Student working 10 hours a week, you still get 4% vacation pay on every dollar you earn.

- Commissions and Overtime count towards your vacation pay calculation. If your boss only calculates it on your "Base Salary," they owe you money.

This guide will teach you how to calculate exactly what you are owed in 2026, how to spot errors on your pay stub, and what to do if your employer refuses to pay out your "banked" vacation when you quit.

Checking your pay stub? Ensure your EI Deductions are also correct or learn how to Resign Gracefully if you find theft.

The Golden Rule: 4% vs. 6%

Under the Employment Standards Act (ESA), your entitlement depends on your "Length of Employment."

Less than 5 Years: 4% (2 Weeks)

- The Rule: You earn 2 weeks of vacation time per year.

- The Pay: You earn 4% of your "Gross Wages" as vacation pay.

- The Math:

- You earn $40,000 / year.

- Vacation Pay = $40,000 x 0.04 = **$1,600**.

- $1,600 is exactly 2 weeks of pay ($800/week).

5 Years or More: 6% (3 Weeks)

- The Rule: Once you hit your 5-year anniversary, you earn 3 weeks of vacation time.

- The Pay: You earn 6% of your "Gross Wages."

- The Math:

- You earn $40,000 / year.

- Vacation Pay = $40,000 x 0.06 = **$2,400**.

Warning: Many employers "forget" to switch you from 4% to 6% on your 5th anniversary. Check your pay stub immediately.

The "Gross Wages" Trap (Hidden Money)

Most people think Vacation Pay is just a percentage of their hourly rate.

Wrong.

In Ontario, Vacation Pay is calculated on GROSS WAGES, which includes:

- Overtime Pay (Time and a half).

- Commissions (Sales bonuses).

- Public Holiday Pay (Stat pay).

- Shift Premiums.

The Scam:

Your boss calculates your 4% only on your "Regular Hours" and ignores your $5,000 in Overtime.

- The Loss: 4% of $5,000 is **$200**. They stole $200 from you.

Internal Link: If you work in sales (like Vector Marketing), ensure your commissions are included in this calculation.

How is it Paid? (Accrued vs. Per Cheque)

There are two legal ways to pay this. Check your contract.

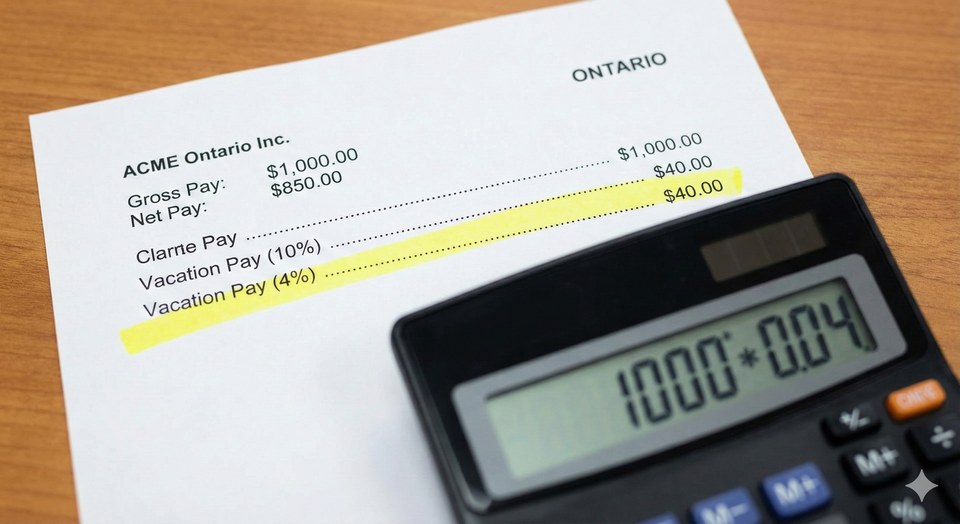

Method 1: Paid on Every Cheque

- Who does this: McDonald's, Tim Hortons, Agencies, Retail.

- How it looks: Your pay stub says: "Vacation Pay: $34.50".

- The Consequence: When you take a week off in July, you get $0.00. You already spent your vacation money every two weeks to buy groceries.

2. Accrued (Banked)

- Who does this: Office jobs, Salaried roles.

- How it looks: Your pay stub says: "Vacation Bank: $1,200".

- The Consequence: When you take a week off, they continue to pay your salary using the money in the bank.

- The Risk: If the company goes bankrupt, you lose your bank.

Practical Questions Answered

"My boss says 'Use it or Lose it'. Is that legal?"

Sort of.

- Vacation TIME: They can force you to take vacation time before the year ends (or schedule it for you).

- Vacation PAY: They CANNOT take your money. If you don't take the time off, they MUST pay out the money as a lump sum. They cannot just delete the dollars from your bank.

"I quit. When do I get my vacation pay?"

Within 7 Days.

- The law says they must pay all outstanding wages (including vacation pay) within 7 days of your employment ending, or on your next regular pay day (whichever is later).

"Do I get vacation pay on my vacation pay?"

No.

- You do not get 4% on the 4% payout. That is circular math.

Deep Dive: How to Calculate Your Own Payout

Don't trust payroll software. Do the math yourself.

Step 1: Find Your T4 or Last Pay Stub

Look at your "Year to Date" (YTD) Gross Earnings.

- Example: $35,000.

Step 2: Subtract the Vacation Pay Already Paid

- Example: You received $0.00 because it is banked.

Step 3: Multiply by 0.04 (or 0.06)

- $35,000 x 0.04 = **$1,400**.

Step 4: Compare to Your "Vacation Bank" Balance

- Does your pay stub say "Vacation Bank: $1,400"?

- If it says $1,200, ask payroll: "Where is the missing $200? Did you include my Overtime in the calculation?"

Frequently Asked Questions

Does being "Salaried" change anything?

No.

Even if you are on a $60k salary, the law is the same. 2 weeks equals 4%.

- The confusion: Salaried people get paid "while they are away." This is their vacation pay. It just feels seamless.

What about Students?

Same Rules.

If you are 15 years old working part-time, you get 4%. Check your pay stub. If you earn $100, you should get $104.

Can I ask for 3 weeks before 5 years?

Yes.

The ESA is the minimum. You can negotiate 3 weeks (6%) in your job offer.

- Negotiation Tip: "I have 5 years of industry experience, even if I am new to this company. I would like to match my previous entitlement of 3 weeks."

Deep Dive: "Stub Periods" & The Public Holiday Pay Interaction

1. The "Stub Period" Confusion

This is a payroll term that confuses everyone.

- Scenario: You start a job on November 1st. The company's "Vacation Year" is Jan 1 to Dec 31.

- The Stub: The period from Nov 1 to Dec 31 is your "Stub Period."

- The Rule: You earn pro-rated vacation for these 2 months.

- Why it matters: On January 1st, you might be told: "You don't have 2 weeks vacation yet." This is true. You only have ~3 days earned from the stub period. You don't get the full 2 weeks until you finish a full year.

2. Vacation Pay on Public Holiday Pay?

- The Question: Do I get 4% vacation pay on my Christmas Stat Pay?

- The Answer: YES.

- The Math: If you get $150 for Christmas Day (Public Holiday Pay), you earn 4% on that $150 ($6.00).

- The Theft: Lazy payroll systems often exclude Stat Pay from the vacation calculation. Over 5 years, this adds up to hundreds of dollars.

3. Negotiating "Paid Vacation" vs. "Vacation Pay"

- Vacation Time: The right to be absent.

- Vacation Pay: The money.

- Contractor Trap: If you are an "Independent Contractor" (like a TaskRabbit Tasker), you get 0%.

- Misclassification: If you work 9-5 for one boss but they call you a "Contractor" to avoid paying the 4%, file a CRA Ruling. You might be owed thousands in back pay.

4. Taking "Unpaid" Vacation

- Can you take 4 weeks off if you only have 2 weeks paid?

- Employer Discretion: Legally, they only have to give you 2 weeks. Anything extra is up to them.

- The Risk: If you take 2 weeks unpaid, remember that you earn $0 vacation pay during those weeks. Your bank will be smaller next year.

5. The "Bonus" Loophole

- Discretionary Bonus: (e.g., "Christmas Gift"). Usually Excluded from vacation pay.

- Non-Discretionary Bonus: (e.g., "Sales Performance", "Production Target"). Usually Included.

- The Fight: If your contract says "Performance Bonus," you are owed 4% on that bonus. If the boss says "No, that's just a gift," they are likely lying to save 4%.

6. Calculating "Single Day" Vacation

- You want to take 1 day off (Friday).

- Formula: Daily Rate = Weekly Salary / 5.

- The Bank Drawdown: Your employer will deduct 1 day's worth of wages from your vacation bank.

- Check: Ensure they don't deduct more than you were paid. (e.g., Deducting $200 when you only earn $180/day).

7. What if My Employer Goes Bankrupt?

- This is the nightmare scenario.

- The Protection: The WEPP (Wage Earner Protection Program) covers up to ~$8,000 of unpaid wages/vacation pay if your employer declares bankruptcy.

- The Action: You must file a proof of claim with the Trustee immediately.

8. Record Keeping for Part-Timers

- Part-timers often work irregular hours.

- The Tracking: Keep a spreadsheet of your gross earnings every pay stub.

- The Calculation: Column A (Gross Pay) x 0.04 = Column B (Vacation Owed).

- The Reconciliation: Once a year, sum up Column B and compare it to the "Vacation Paid" on your T4. They should match exactly.

9. When 4% is Actually 3.8% (The Rounding Error)

- Some payroll software rounds down every decimal.

- Over 26 pay periods, this is pennies. But it shows the employer's mindset.

- Advice: Don't fight over $0.50. Fight over the missing Overtime inclusion.

10. "Unlimited Vacation" Policies (The Tech Trap)

- Some tech companies offer "Unlimited Vacation."

- The Trap: If you have "Unlimited" vacation, you technically accrue $0.00 vacation pay liability on the books.

- The Result: When you quit, they owe you nothing.

- ESA Rule: They still must ensure you take at least the statutory minimum (2 weeks) and receive at least 4% of your wages. They cannot use "Unlimited" to pay you less than the ESA minimum.

Summary: Check Your Stub Today

- Check the Rate: Are you getting 4% or 6%?

- Check the Base: Are they including Overtime and Commissions?

- Check the Bank: If you quit, demand your payout.

- Don't Lose It: Never let them delete your banked dollars.

About the author

Jeff Calixte (MC Yow-Z) is a Canadian career researcher and digital entrepreneur who studies hiring trends, labour market data, and real entry-level opportunities across Canada. He specializes in simplifying the job search for newcomers, students, and workers using practical, up-to-date information.

Sources

- Ontario Ministry of Labour: Guide to Vacation Pay. https://www.ontario.ca/document/your-guide-employment-standards-act-0/vacation

- Employment Standards Act, 2000: Full legislation. https://www.ontario.ca/laws/statute/00e41

- Steps to Justice: Vacation pay rights tool. https://stepstojustice.ca/legal-topic/employment-and-work/getting-paid/vacation-holiday-pay/

Note

Job availability, wages, and hiring conditions can vary widely by province, employer, season, and experience level. All salary ranges and job examples in this guide are estimates based on current labour market data. Always confirm details directly with the employer before applying.